How To Record Credit Card Cashback Rewards In QuickBooks?

Contents:

A little web research brought up two approaches for recording credit card cash rewards in QuickBooks. I feel like I’m being rewarded for spending money, which is great. I always make sure to use my credit card for all of my purchases so that I can get the most cash back possible. It’s nice to know that there’s a little bit of money coming back to me every time I make a purchase. Most people are familiar with the various credit card companies that offer cash back rewards and even some mail-in rebate offers.

To maximize your credit card rewards, choose a card with a variety of bonus categories. BankAmeriDeals rewards vary depending on whether you’re a merchant or a purchase type. A reward program is a type of credit or debit card that allows you to earn cash back, statement credits, or gift cards. Typically, cash back is deposited into your PayPal or bank account. The cashback rewards you get from your credit card account is usually not part of the business income. You can categorize the downloaded transaction as Personal within the system.

Top 9 Best Movies of All Time

One of the simplest ways to manage your accounting is to apply cashback to a single account. Ramp offers a flat 1.5 percent cashback on all purchases, which we believe makes compensating for it easier. When cashback is added to income but not expenses, the same tax bracket will apply as when cashback is deducted from expenses but not income.

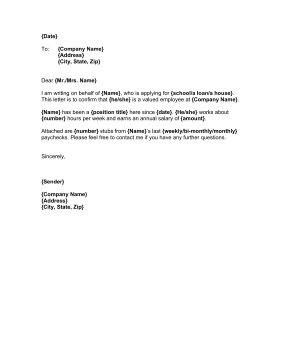

In the Online adaptation of the QuickBooks programming, the Mastercard cashback prizes can be recorded. The credits created from your card can be added through it. Presently, you want to pick a payee, and after that incorporate the Credit Card Account. When you get the Mastercard cashback rewards, you might need to record them in your QuickBooks to represent any reference later on. For every single such prize, you want to go to the Banking button. After tapping on it, you should tap on Credit Card Charges and Create And Apply Credit Memo In QuickBooks Online.

How to Record Credit Card Cash Rewards in QuickBooks

The fee for all foreign transactions is 2.7% of the transaction value. If you make an eligible purchase through Bank of America, the bank will record it and contact the merchant to verify the purchase. As soon as the purchase is approved, Bank of America will issue a payment to the merchant and record it in your Bank of America account. A diverse selection of participating merchants provides cardholders with various discounts on goods and services. Cashback is available on purchases made with eligible Bank of America cards. For more information about BankAmeriDeals or to apply, visit BankAmeriDeals.com.

Cash Back Rewards should be credited as discounts and price adjustments to the purchase rather than income. The refund will be classified as income, but it will not be included in the gross receipts. Other sources of revenue are commonly used by entrepreneurs or businessmen to cover the account. As a credit card, users can use their cash back rewards.

Select either the Expenses orItems tab, then enter all the necessary details. I think it makes more sense if it is classified as an expense. It will reduce expense and have the same bottom line effect as increasing income. I like to put it as Other Income so that I can see that I received money without it showing up as Revenue. I believe that IRS description is referring to rebates in general, not as to BUSINESS accounting.

There’s no need to worry about the details of your life because TurboTax Free Edition can assist you in filling out simple questions. You will get unlimited advice and a detailed review from an expert. I have been following this thread and I disagree with how you folks are accounting for a credit card cash-back reward. If this is based on spending , then the cash back is actually a rebate or discount on your expenses.

Debit CreditCash in the bank is worth $US20, and other incomes are worth $US50 or more. When you make a purchase with a cash-back site or app, it is recorded, and you can earn money after it has been approved and processed. You usually receive cash back when you use PayPal or a bank account.

How To Record Cash Back Rewards In Quickbooks

Next, set up the mapping of the file column related to the QuickBooks field. Dancing Numbers template file does this automatically; you just need to download the Dancing Number Template file. Our error free add-on enables you to focus on your work and boost productivity. Showing it as an adjusting by offsetting the expense or purchases. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop.

For example, you could the eight steps of the accounting cycle a category for groceries, another for gas, and another for entertainment. This can help you see how much you are spending on each type of purchase. Another way to categorize cash back rewards in QuickBooks is to create a separate account for each type of purchase. This can be a helpful way to track your spending and see where your money is going. Finally, you can also create a report that shows you how much you are spending on each type of purchase. This can be a helpful way to see where your money is going and track your spending.

The Different Ways Cash Back Rewards Are Treated By The Irs

It is NOT taxable income and so should not be an income account. If you use cash back on your credit card bill, you will save money. The IRS considers the rewards received from the card, such as cash-back bonuses, to be a rebate rather than taxable income. Tax breaks provided for opening an account could be considered taxable income if they are only for providing rewards. It’s a good all-around business credit card because there’s no annual fee, and it’s especially useful for financing large purchases for 12 months at 0% APR.

This can be done by creating a separate account for cash back rewards and then recording each transaction that results in cash back. Choosing a credit card based on your lifestyle and what you value is the best way to get the most bang for your buck. You can use virtual credit cards for online transactions because they are a digital replica of your physical card. Take a look at the value and flexibility of the card’s points or cash back, as well as its benefits. Here are some useful tips to keep in mind when spending a lot of money on gaming.

Select a Country

Next, find the credit card account that you want to add the cash back rewards to. Once you’ve located the account, click on the “Edit” button. In the “Edit Credit Card” window, scroll down to the “Cash Back” section. Here, you’ll need to enter the amount of cash back that you’ve earned.

https://bookkeeping-reviews.com/ credits earned from your credit card are generally not part of your business. When a user uses a credit card to refund money when paying with the same card, they are unsure of how the refund will be handled by QuickBooks. By following these steps, you can accurately record cash back rewards in QuickBooks.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

In addition, when you create a bill or any expense transaction with the amount of $92, it will increased your Accounts Payables or expense account. Once you record a payment for $52, it will be posted to the Deposit To account you selected. How to record credit card Cash Rewards in QuickBooks Online? I currently also receive cash back Rewards from my Paypal checking debit card.

Best Free Accounting Software (2023) – Forbes Advisor – Forbes

Best Free Accounting Software ( – Forbes Advisor.

Posted: Mon, 09 Jan 2023 08:00:00 GMT [source]

The two approaches used to record credit card cash rewards differ. To record the cash flow, you must create an income account in QuickBooks. Once you’ve established your income account, you can start using your cash back rewards as credit cards. It will not be reported on your gross receipts because it is only classified as income. QuickBooks also has added a few new categories in which you can add cash back rewards to your credit cards. There are many different types of credit card rewards that can be offered by different credit card companies.

When ABC receives these rewards, its accountant must record them as other income on the income statement. There are a few things to keep in mind when recording a credit card cash advance in QuickBooks Online. First, you’ll need to create a new bank account for the advance. You can do this by going to the Banking menu and selecting Add New Account. Once the account is created, you can then link it to your credit card account.